Can I Claim My Home Office On My Taxes . If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of a work space in your. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Home office deduction at a glance. Can i refurbish my home office through my limited company? Here, exclusively for contractoruk, i will explore what expenses. In the construction industry, your business location. Can i claim a home office deduction if i work at both the job site and my home office? You can claim the deduction whether you’re a homeowner or a renter, and you can use the deduction for any type of home where you reside: If you use part of your home exclusively and regularly for conducting business, you may be.

from www.vrogue.co

If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Here, exclusively for contractoruk, i will explore what expenses. If you use part of your home exclusively and regularly for conducting business, you may be. You can claim the deduction whether you’re a homeowner or a renter, and you can use the deduction for any type of home where you reside: Can i claim a home office deduction if i work at both the job site and my home office? Can i refurbish my home office through my limited company? Home office deduction at a glance. In the construction industry, your business location. If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of a work space in your.

Authorization Letter Claim Tax Refund For Sample Printable Formats Vrogue

Can I Claim My Home Office On My Taxes You can claim the deduction whether you’re a homeowner or a renter, and you can use the deduction for any type of home where you reside: Here, exclusively for contractoruk, i will explore what expenses. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Can i refurbish my home office through my limited company? If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of a work space in your. Can i claim a home office deduction if i work at both the job site and my home office? You can claim the deduction whether you’re a homeowner or a renter, and you can use the deduction for any type of home where you reside: In the construction industry, your business location. Home office deduction at a glance. If you use part of your home exclusively and regularly for conducting business, you may be.

From www.templateroller.com

Sample Letter to Insurance Company to Pay Claim Download Printable PDF Can I Claim My Home Office On My Taxes If you use part of your home exclusively and regularly for conducting business, you may be. Can i refurbish my home office through my limited company? Home office deduction at a glance. Can i claim a home office deduction if i work at both the job site and my home office? If you meet the eligibility criteria, you can claim. Can I Claim My Home Office On My Taxes.

From mungfali.com

Sample Of Claim Letter Of Payment Can I Claim My Home Office On My Taxes In the construction industry, your business location. You can claim the deduction whether you’re a homeowner or a renter, and you can use the deduction for any type of home where you reside: If you use part of your home exclusively and regularly for conducting business, you may be. If you are required by your employer to work from home. Can I Claim My Home Office On My Taxes.

From www.pinterest.com

Letter Format tax department for demand notice Evaluation Form Can I Claim My Home Office On My Taxes In the construction industry, your business location. If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of a work space in your. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Home office deduction at a glance. Here,. Can I Claim My Home Office On My Taxes.

From tmdaccounting.com

Can I Claim Medical Expenses on My Taxes? TMD Accounting Can I Claim My Home Office On My Taxes If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of a work space in your. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Here, exclusively for contractoruk, i will explore what expenses. Home office deduction at a. Can I Claim My Home Office On My Taxes.

From everhour.com

Funny Accounting Memes to Get You Through Tax Season Can I Claim My Home Office On My Taxes Here, exclusively for contractoruk, i will explore what expenses. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Home office deduction at a glance. If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of a work space in. Can I Claim My Home Office On My Taxes.

From templatelab.com

49 Free Claim Letter Examples How to Write a Claim Letter? Can I Claim My Home Office On My Taxes Can i claim a home office deduction if i work at both the job site and my home office? In the construction industry, your business location. If you use part of your home exclusively and regularly for conducting business, you may be. Here, exclusively for contractoruk, i will explore what expenses. If you meet the eligibility criteria, you can claim. Can I Claim My Home Office On My Taxes.

From www.pinterest.com.au

Taxes You Can Write Off When You Work From Home [INFOGRAPHIC Can I Claim My Home Office On My Taxes Can i claim a home office deduction if i work at both the job site and my home office? Home office deduction at a glance. You can claim the deduction whether you’re a homeowner or a renter, and you can use the deduction for any type of home where you reside: In the construction industry, your business location. If you. Can I Claim My Home Office On My Taxes.

From rechargevodafone.co.uk

🔴 What Can I Claim On My Taxes 2024 Updated RECHARGUE YOUR LIFE Can I Claim My Home Office On My Taxes If you use part of your home exclusively and regularly for conducting business, you may be. Can i claim a home office deduction if i work at both the job site and my home office? Home office deduction at a glance. You can claim the deduction whether you’re a homeowner or a renter, and you can use the deduction for. Can I Claim My Home Office On My Taxes.

From templatelab.com

49 Free Claim Letter Examples How to Write a Claim Letter? Can I Claim My Home Office On My Taxes Here, exclusively for contractoruk, i will explore what expenses. You can claim the deduction whether you’re a homeowner or a renter, and you can use the deduction for any type of home where you reside: Home office deduction at a glance. If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of. Can I Claim My Home Office On My Taxes.

From fabalabse.com

Can a stay at home mom claim child care expenses? Leia aqui Can stay Can I Claim My Home Office On My Taxes If you use part of your home exclusively and regularly for conducting business, you may be. Can i claim a home office deduction if i work at both the job site and my home office? Can i refurbish my home office through my limited company? Home office deduction at a glance. If you are required by your employer to work. Can I Claim My Home Office On My Taxes.

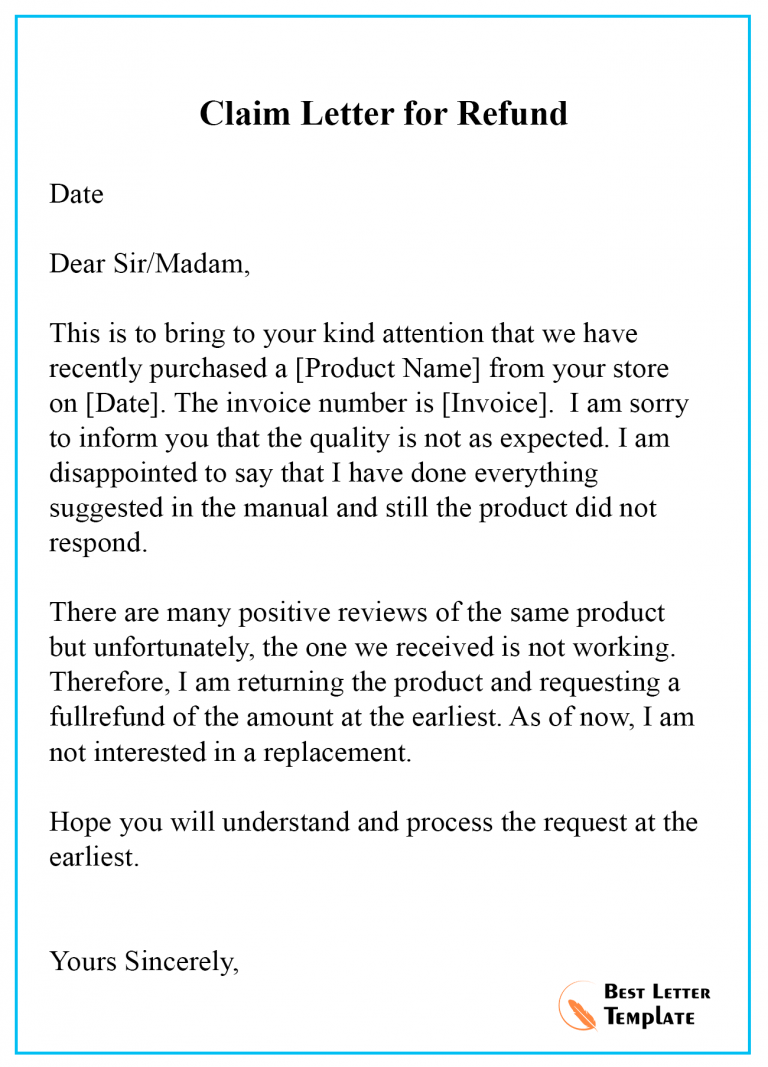

From bestlettertemplate.com

Tax Letter Template Format, Sample, and Example in PDF & Word Can I Claim My Home Office On My Taxes If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of a work space in your. In the construction industry, your business location. Can i claim a home office deduction if i work at both the job site and my home office? Can i refurbish my home office through my limited company?. Can I Claim My Home Office On My Taxes.

From sg-accounting.co.uk

How much can I claim for using my home as an office • SG Accounting Can I Claim My Home Office On My Taxes Can i claim a home office deduction if i work at both the job site and my home office? You can claim the deduction whether you’re a homeowner or a renter, and you can use the deduction for any type of home where you reside: If you meet the eligibility criteria, you can claim a portion of certain expenses related. Can I Claim My Home Office On My Taxes.

From staycanada.info

Tax Return Should I claim 400 or 3,000 for Home Office Expenses for Can I Claim My Home Office On My Taxes If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Can i claim a home office deduction if i work at both the job site and my home office? Here, exclusively for contractoruk, i will explore what expenses. Home office deduction at a glance. In the construction industry,. Can I Claim My Home Office On My Taxes.

From besttabletsforkids.org

Can I deduct child care expenses on my taxes? 2024 Can I Claim My Home Office On My Taxes In the construction industry, your business location. Home office deduction at a glance. Can i refurbish my home office through my limited company? Can i claim a home office deduction if i work at both the job site and my home office? Here, exclusively for contractoruk, i will explore what expenses. If you are required by your employer to work. Can I Claim My Home Office On My Taxes.

From utaheducationfacts.com

How To Write A Claim Can I Claim My Home Office On My Taxes If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of a work space in your. In the construction industry, your business location. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Can i claim a home office deduction. Can I Claim My Home Office On My Taxes.

From templatelab.com

49 Free Claim Letter Examples How to Write a Claim Letter? Can I Claim My Home Office On My Taxes Home office deduction at a glance. Here, exclusively for contractoruk, i will explore what expenses. If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of a work space in your. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges. Can I Claim My Home Office On My Taxes.

From www.youtube.com

What Can I Claim on My Taxes if I Have a Second Job Besides My Home Can I Claim My Home Office On My Taxes Can i claim a home office deduction if i work at both the job site and my home office? If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of a work space in your. Can i refurbish my home office through my limited company? Here, exclusively for contractoruk, i will explore. Can I Claim My Home Office On My Taxes.

From templatelab.com

49 Free Claim Letter Examples How to Write a Claim Letter? Can I Claim My Home Office On My Taxes If you use part of your home exclusively and regularly for conducting business, you may be. If you meet the eligibility criteria, you can claim a portion of certain expenses related to the use of a work space in your. If you are required by your employer to work from home and the resulting home office expenses such as electricity. Can I Claim My Home Office On My Taxes.